Hair loss can be tough. It can affect your self-esteem and confidence, especially for women dealing with conditions like alopecia.

A quality wig can make a difference. It can empower you and enhance your individual style with grace and confidence.

But wigs can be expensive. This is where tax deductions for wigs come into play.

Did you know that you can claim tax deductions for wigs? Yes, under certain conditions, wigs can be considered a tax-deductible medical expense.

This article will guide you through the process. We'll discuss the requirements for a wig to be tax-deductible and how to claim this expense on your tax return.

Our goal is to help you navigate the tax system and find financial relief for your wig expenses. Let's dive in.

Table of Contents

- Understanding the Tax Deduction for Wigs

- Requirements for Wigs as Tax Deductible

- How to Add Wigs as Tax Deductible on Your Return

- Getting Tax Help for Claiming Wig Expenses

- Summary of Steps to Deduct Your Wig Purchase

- Frequently Asked Questions About Tax Deductions for Wigs

- FAQs

- Conclusion and Next Steps

Understanding the Tax Deduction for Wigs

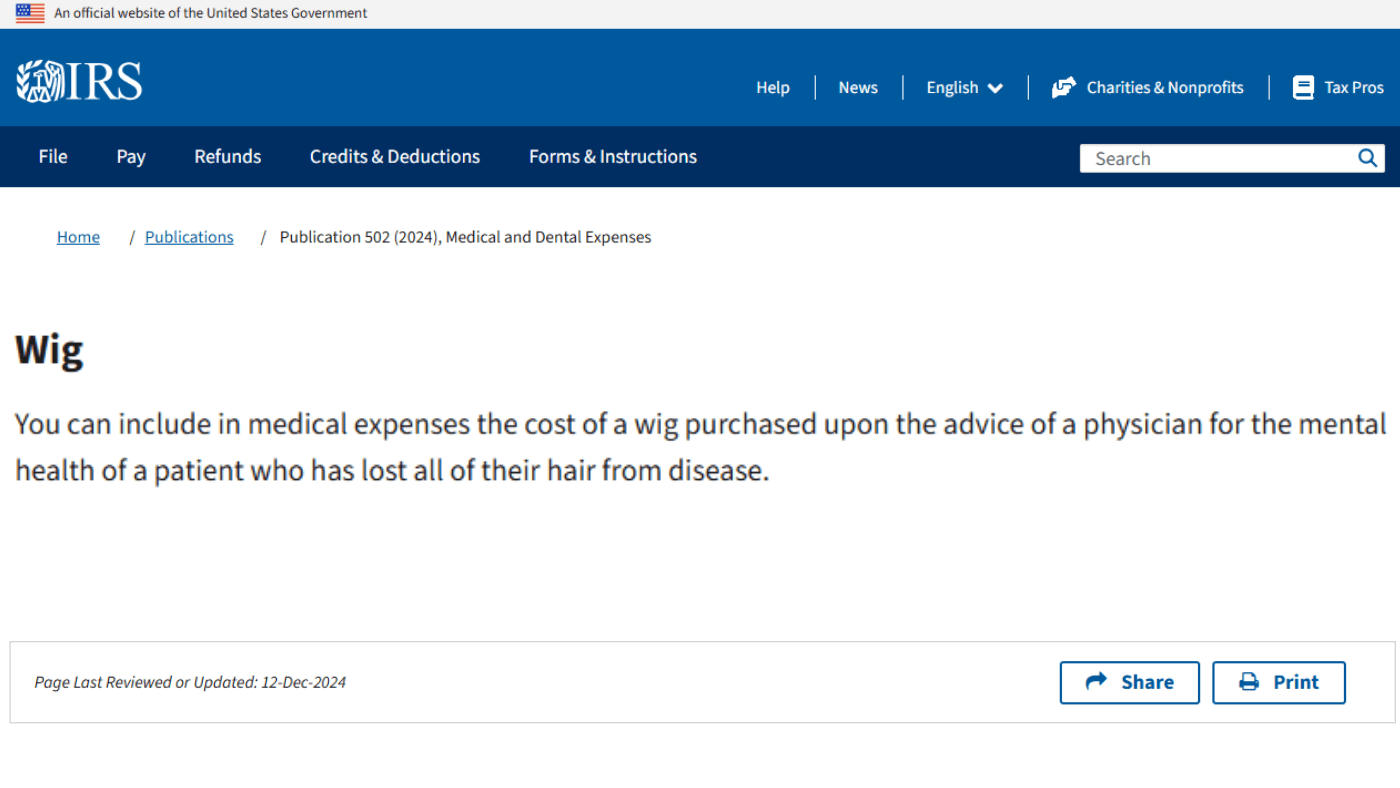

Screenshot of the IRS website (irs.gov/publications/p502) as of 03.14.2025

Wigs can be considered a tax-deductible expense. However, not all wig purchases qualify for this deduction. The Internal Revenue Service (IRS) sets specific criteria.

Firstly, the wig must be medically necessary. It's essential that the wig is recommended by a healthcare provider for treating hair loss from a medical condition, such as alopecia or chemotherapy.

Here’s a quick overview of what you need to know:

- The wig must be prescribed by a physician.

- The purpose of the wig should be related to a medical condition.

- The expenses must exceed 7.5% of your adjusted gross income.

Documentation is crucial. Maintain records including a prescription or doctor's note confirming the medical necessity of the wig.

You'll also need to itemize your deductions using Schedule A on Form 1040. This means you must choose to forgo the standard deduction to claim this as a medical expense.

Remember, only out-of-pocket expenses are deductible. If insurance covers your wig, it may not qualify.

The IRS Publication 502 offers further guidance on deductible medical expenses. Always stay informed and consult a tax professional if unsure.

Does Your Wig Qualify as a Tax Write-Off?

To determine if your wig qualifies as a tax write-off, consider whether it was purchased due to a medical necessity. It's vital to have a physician's prescription or a detailed statement highlighting the need for a wig due to medical treatment.

Hair loss due to disease, such as cancer treatments or alopecia, is a key qualifier. Ensure the documentation clearly states that the wig helps with a medical condition, improving emotional well-being.

It's also important to note that the wig should not be obtained for purely cosmetic purposes. Wigs purchased without a medical recommendation typically don't qualify for tax deductions.

Evaluate whether your wig expenses and other medical costs exceed the IRS threshold of 7.5% of your AGI. If they do, you’re on the right path.

Keep in mind, this deduction applies to the actual cost of the wig, including any maintenance, like cleaning or repairs. Always retain receipts and relevant documentation to support your claim when filing taxes.

Requirements for Wigs as Tax Deductible

To claim a wig as tax-deductible, specific conditions must be met. Firstly, there must be a clear medical need for the wig. A physician’s prescription is essential for this documentation.

The wig must aid in treating hair loss due to a medical condition. This can include treatments like chemotherapy causing hair loss. It's important to note that purely cosmetic wigs do not qualify.

The financial aspect is crucial as well. Here’s a summary of financial requirements:

- Medical expenses must surpass 7.5% of your adjusted gross income (AGI).

- Only out-of-pocket expenses count.

- Insurance-covered costs are not deductible.

Documentation such as receipts, doctor’s notes, and any correspondence related to the wig is vital. This paperwork will support your claim and ensure compliance with IRS guidelines.

If audited, having detailed records is crucial. It validates the wig's role as a medical expense. Consider keeping these documents organized throughout the year.

Obtaining a Prescription for a Medical Wig

A medical prescription for a wig is key to claiming a tax deduction. Start by consulting with your healthcare provider. They can assess your need for a wig due to medical reasons, such as hair loss from disease.

Types of Physicians Who Can Prescribe Wigs:

- Oncologists

- Dermatologists

- General practitioners

- Psychiatrist

- Other specialists relating to hair loss

Here are some common diseases associated with hair loss:

- Alopecia Areata: An autoimmune disorder causing sudden hair loss in patches.

- Chemotherapy-Induced Hair Loss: Hair loss due to cancer treatments that attack rapidly dividing cells.

- Androgenetic Alopecia: Also known as male or female pattern baldness, is often hereditary.

- Scarring Alopecia: A group of conditions that destroy hair follicles, leading to permanent hair loss.

- Telogen Effluvium: Temporary hair loss often triggered by stress, hormonal changes, or medical conditions.

Your doctor can then provide a written prescription. This document should clearly state the necessity of the wig for medical reasons. It's crucial for your tax records.

A physician's note supports your deduction claim. Be sure it includes specific details about your condition. Retain this prescription as part of your tax documentation. It’s a vital piece of evidence for the IRS.

Documenting Your Hair Loss from Disease

Proper documentation of hair loss is essential for tax purposes. Start by maintaining a medical history. This can include visits to specialists for conditions causing hair loss, such as alopecia or chemotherapy.

Keep all relevant medical records. These can include diagnoses and treatment plans affecting your hair. Also, collect any visual documentation, like photographs that show the progression of hair loss.

Such documentation provides evidence of your condition. It bolsters the medical necessity of a wig. Ensuring these records are comprehensive and well-organized will assist in justifying your tax deduction claim if questioned.

Collecting this information not only helps with your tax deduction but also serves as valuable documentation for your ongoing medical care.

How to Add Wigs as Tax Deductible on Your Return

When it comes to filing taxes, deducting wig expenses requires specific steps. Begin by ensuring all prerequisites are met. This includes having the necessary medical documentation and receipts.

It's essential to itemize your deductions. This means listing every eligible expense individually. Using Schedule A on Form 1040 will allow you to record these costs accurately.

Here's a quick guide on the process:

- Gather all medical receipts, including those for the wig.

- Attach your doctor’s prescription to your tax records.

- Fill out Schedule A with all medical expenses exceeding 7.5% of your AGI.

- Include costs related to maintaining the wig, such as cleaning.

Accuracy is crucial. Double-check each amount and detail for precision. This ensures compliance with IRS guidelines and maximizes your potential deduction.

Finally, remember to store all related documentation securely. This will be vital if further verification is required by the IRS. Properly maintaining these records helps substantiate your claims effectively.

Itemizing Your Deductions on Schedule A (Form 1040)

Itemizing deductions is a pivotal step for claiming a wig expense. Use Schedule A on Form 1040 to report your medical expenses. This includes the cost of wigs advised for medical reasons.

First, calculate your total medical expenses. Ensure these costs surpass 7.5% of your adjusted gross income. Only then will they qualify for a deduction on your return.

It's crucial to be precise. Enter the exact amount spent on the wig and associated medical costs. Be detailed to ensure transparency and accuracy.

Retain all supporting documentation, like receipts and medical prescriptions. This substantiates your claim and assists if the IRS requires further clarification. Properly itemizing ensures you legitimately lower your taxable income.

Getting Tax Help for Claiming Wig Expenses

Navigating tax deductions can be complex. Seeking help can ease the process significantly. Consider using tax software or services that specialize in medical expense claims.

They can offer guidance on proper documentation. This ensures you meet all IRS requirements effectively. Their expertise could save you both time and money.

Consulting with a Tax Professional

Consulting a tax professional provides tailored advice. They can clarify any confusion around deducting medical wig expenses. This personalized insight ensures you're leveraging deductions correctly.

A professional will help identify potential deductions you might overlook. This maximizes your tax savings and ensures compliance. They become an invaluable resource during tax season.

Summary of Steps to Deduct Your Wig Purchase

- Understand Eligibility: Confirm that your wig is medically necessary and meets IRS criteria for deductions.

- Visit the IRS Website: Look for information on wig deductions and take a screenshot for your records.

- Obtain a Prescription: Get a prescription for your wig from a licensed physician to validate the medical necessity.

- Document Your Condition: Keep a detailed account of your medical condition that necessitates the wig.

- Update Your Receipt: If possible, have your receipt reflect the wig as a "cranial prosthesis" for clarity.

- Organize Your Records: Maintain a file with all relevant documents like medical history and receipts.

- Consult Your CPA: Discuss your situation with a Certified Public Accountant (CPA) to ensure you're maximizing your deduction.

- Review State Deductions: Check your state tax laws for any additional credits or deductions.

- Add Wig Costs to Your Itemized Deductions: Record the purchase cost of your wig on your itemized deductions using Form 1040.

- Keep Your Documentation: Retain all receipts and screenshots securely for reference and potential audits.

Frequently Asked Questions About Tax Deductions for Wigs

Many have queries about claiming wigs as a tax deduction. Below are common concerns addressed simply and clearly. Familiarize yourself with these to ensure you're well-prepared.

FAQs

Can you write off wigs for cosmetic purposes?

No, only medically necessary wigs are deductible.

Is a prescription required for the deduction?

Yes, a doctor’s prescription or statement is necessary.

What documentation should I keep?

Retain all receipts and medical documentation related to your wig purchase.

*These FAQs cover essential points. They're designed to demystify the process. Always consult a professional for personalized advice.

Conclusion and Next Steps

Navigating tax deductions for wigs can seem complex, particularly when filing taxes with the IRS in the United States. However, understanding the basics can simplify the process. It’s essential to have solid documentation to support your claims.

As you prepare your tax return, be sure to check with your Certified Public Accountant (CPA) for personalized advice on your situation. Additionally, don't forget to check your state laws to see if there are any available credits or deductions for medical hair loss. Beginning to organize your documents now will set you up for a smoother tax season ahead.

For more information, visit irs.gov/publications/p502.

Ready to take the next step and embrace every moment with confidence? Discover the empowering elegance of our wig collection and learn how to make the most of your tax deductions!

HERA 15" | Remy Human Hair Lace Front WIG (Hand-Tied)

$2,999.00

Hair Type: Remy Human Hair Hair Length: 15” crown to tips. Front: 12”. Side 9”. Back 9”,12”,13”. Nape 9” Cap Size Medium: (21.5"). Circumference: 21 ½", Front to Back: 14 ½ “, Ear to Ear 13 ¼” Cap Size Small: (21"), Circumference: 21",… read more

Hera 19" | Remy Human Hair Lace Front Wig (Hand-Tied)

$3,299.00

Hair Type: Remy Human Hair Hair Length: 19” crown to tips. Front: 13”. Side: 13”. Back: 13”-14". Nape: 13” Cap Size Medium: (21.5"). Circumference: 21 ½“. Front to Back: 14 ½“. Ear to Ear: 13 ¼” Cap Size Small: (21"), Circumference: 21",… read more